Average deductions from paycheck

However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Your employer or payer will calculate how much income tax to deduct by referring to your total claim amount on Form TD1 Personal Tax Credits Return and using approved calculation methods.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

You need to save 10 if you start at age 35 22 if you start at age 45 and 52 of every paycheck if you start at age 55.

. Your effective tax rate is just under 14 but you are in the 22 tax bracket. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Theres a shortfall of 50 in your till and your employer wants to deduct this from your earnings.

Additionally the FICA and State Insurance Taxes would take away 790 for a tax deduction. Youre paid 250 gross per week. 22 on the last 10526 231572.

Simplify Your Day-to-Day With The Best Payroll Services. Therefore the total amount of taxes paid annually would be 4403. Unlike Social Security Medicare is fully taxed on all of your income and if your earnings exceed 200000 youll pay an.

It can also be used to help fill steps 3 and 4 of a W-4 form. Some deductions from your paycheck are made post-tax. This means the total percentage for tax deduction is 169.

The amount of money you. Ad This is the newest place to search delivering top results from across the web. Employers withhold or deduct some of their employees pay in order to cover.

Based on a survey of 2100 employees at non-federal public and private companies KFFs 2017 Employer Health Benefits Survey finds that the average worker pays 5714 toward the cost of family coverage which totals 18764 on average annually. Any income exceeding that amount will not be taxed. You pay the tax on only the first 147000 of your earnings in 2022.

These withholdings constitute the difference between gross pay and net pay and may include. The average marginal tax rate is 259 while the average tax rate is 169 as stated above. Payroll taxes and income tax.

Money may also be deducted or subtracted from. Youd pay a total of 685860 in taxes on 50000 of income or 13717. This calculator is intended for use by US.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments. Your employer can take 10 of your gross earnings which.

These include Roth 401k contributions. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. For single coverage the average worker pays about 1213 annually and yearly premiums average.

Content updated daily for standard payroll deductions. The next dollar you earn is taxed at 22. You need to save 5 of every paycheck if you start at age 25.

Ad Choose From the Best Paycheck Companies Tailored To Your Needs. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. A paycheck to pay for retirement or health benefits.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. If you receive employment income or any other type of income your employer or payer will deduct income tax at source from the amount paid. State sales tax rates in Florida are 600 percent local tax rates are 200 percent and the combined average of state and local sales taxes is 701 percent.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount.

The Measure Of A Plan

Payslip In The Netherlands How Does It Work Blog Parakar

Pin On College Rediness

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Infographic 40 Of Americans Are Living Paycheck To Paycheck Finance Infographic Job Info

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Pin On Innes Tax Resources

See How Your Spending Compares To The Average Joe S Spending Money Spending Habits Spending

Payslip In The Netherlands How Does It Work Blog Parakar

Mary Kay Marketing Plan Sheet Perfect For Team Building Opportunities Find It Only At Www Thepinkbubble Mary Kay Marketing Mary Kay Business Selling Mary Kay

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

A Payroll Face Off With The Top Paid Nhl Players Infographic Top Pay Infographic Payroll

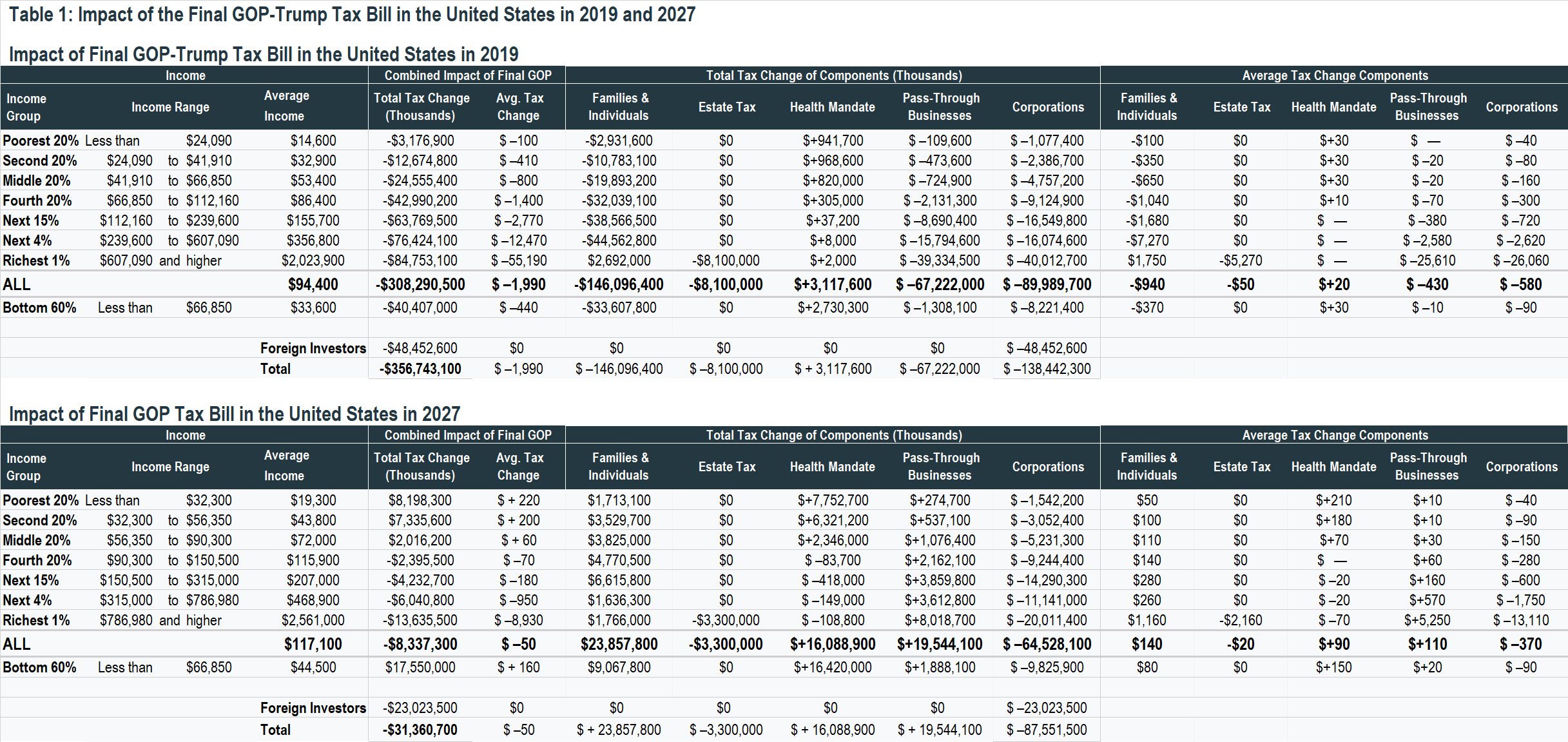

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Why I Use The 50 30 20 Formula Budgeting Money Personal Finance Finance

Check Your Paycheck News Congressman Daniel Webster

Payslip In The Netherlands How Does It Work Blog Parakar

Understanding Your Paycheck Credit Com